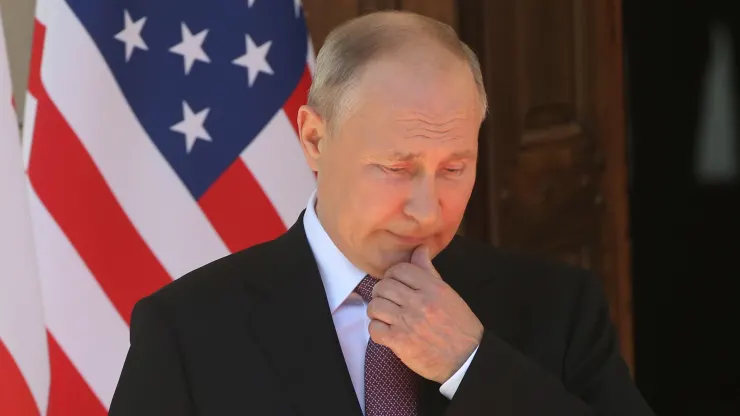

- Tensions between Russia and the West appear to have risen dramatically over the last week.

- In the last few days alone, Russia stopped gas supplies to two European countries and has warned the West several times that the risk of a nuclear war is very “real.”

- Russian President Vladimir Putin said that any foreign intervention in Ukraine would provoke what he called a “lightning fast” response from Moscow.

When relations between the West and Russia were bad, but not so bad: Russian President Vladimir Putin arrives for the U.S. – Russia Summit in 2021 in Switzerland. Mikhail Svetlov | Getty Images News | Getty Images

The saber-rattling and rhetoric between Moscow and the West have become notably more aggressive this week, prompting concerns that a direct confrontation between the two power blocs could be more likely.

In the last few days alone, for example, Russia stopped gas supplies to two European countries and has warned the West several times that the risk of a nuclear war is very “real.”

In addition, Russian President Vladimir Putin has said that any foreign intervention in Ukraine would provoke what he called a “lightning fast” response from Moscow, while his Foreign Ministry warned NATO not to test its patience.

For their part, Western officials have dismissed Russia’s “bravado” and “dangerous” nuclear war rhetoric, with the U.K. calling on Western allies to “double down” on their support for Ukraine.

CNBC asked strategists about the likelihood of a direct confrontation between Russia and the West. Here’s what they said.

Nuclear attack?

At the start of the week, Russia’s foreign minister warned that the threat of a nuclear war “cannot be underestimated” and said NATO’s supply of weapons to Ukraine was tantamount to the military alliance engaging in a proxy war with Russia.

Putin doubled down on the bellicose rhetoric Wednesday, threatening a “lightning fast” retaliation against any country intervening in the Ukraine war and creating what he called “strategic threats for Russia.”

He then appeared to allude to Russia’s arsenal of intercontinental ballistic missiles and nuclear weapons when he warned that Russia has the “tools” for a retaliatory response “that no one else can boast of having now … we will use them if necessary.”

But strategists told CNBC that Putin is playing on risk aversion in the West and that the chances of a nuclear war are remote.

“I think it’s outside the realm of possibility right now that there’s going to be a nuclear war or World War III that really spills over that far beyond Ukraine’s borders,” Samuel Ramani, a geopolitical analyst and associate fellow at the Royal United Services Institute, told CNBC.

“If there’s a border spillover right now, we’re still probably most likely looking at something like Moldova being vulnerable to an invasion,” he said.

A U.S. infantryman at a combined arms live fire exercise at Al-Ghalail Range in Qatar, on Nov. 14, 2018. Spc. Jovi Prevot | U.S. Army

He noted that Russia has a long history of using “nuclear brinkmanship” as a way of preventing the West from pursuing security policies that it doesn’t like, with the escalation in hostile rhetoric aimed at deterring NATO members from making heavy arms deliveries to Ukraine.

Moment of danger

Nonetheless, Ramani noted the threat posed by Russia could become more acute if it felt humiliated on the battlefield. In particular, military setbacks in Ukraine around May 9 could pose some danger. That’s Russia’s “Victory Day” — the anniversary of Nazi Germany’s defeat by the Soviet Union in World War II.

“Putin has had a history of escalating unpredictability if he feels that Russia is being humiliated in some way … and if there are major setbacks, especially on around the 9th [of May] then there’s a risk of unbreakable action,” he said. “But also there’s a logic of mutually assured destruction that hopefully will rein everybody in.”

Threatening nuclear attacks is part of Putin’s “playbook,” said William Alberque, director of strategy, technology and arms control at the International Institute for Strategic Studies think tank.

“Putin enjoys using risks and he thinks he has a much more appetite for risk than the West does,” he told CNBC on Thursday. “He’s trying to use the old playbook of ‘if I terrify you enough, you’ll back down’,” he said.

“Ultimately, if he uses nuclear weapons, even a demonstration strike, this would turn Russia into a global pariah,” Alberque said. He advised Western leaders, “We just need to be able to manage our risk and keep our nerve and not panic when he does something that we might not expect.”

There’s no indication that there will be a direct confrontation, Liviu Horovitz, a nuclear policy researcher at the German Institute for International and Security Affairs, told CNBC.

“Both the United States and Western European governments have repeatedly said that they have no interest in escalating this conflict beyond Ukraine, and I don’t see anything suggesting that NATO troops will be fighting in Ukraine anytime soon.”

Still, if a wider war did break out, “NATO’s overall conventional capabilities outmatch Russia’s,” he noted. What’s important now is that “all sides should avoid any steps that could create misunderstandings,” he said — steps that could lead to an accidental and potentially catastrophic war.

Economic war

While NATO has shied away from providing any aid to Ukraine that could be misconstrued as a direct attack on Russia, Western allies continue to pile on the pressure on Moscow.

Indeed, the economic punishment on Russia has been increasing by the day, in the form of more sanctions on its businesses, key sectors and officials close to or within Putin’s regime. Russia’s own Economy Ministry expects the economy to contract as a result, by 8.8% in 2022 in its base-case scenario, or by 12.4% in a more conservative scenario, Reuters reported.

Russian forces patrol in Mariupol, Ukraine, where the Russian Army has taken control, on April 22, 2022. “There is no end in sight to Russia’s war in Ukraine, and relations with the West will likely continue to deteriorate,” one analyst said. Leon Klein | Anadolu Agency | Getty Images

For its part, Russia has sought to inflict its own pain on European countries that are, awkwardly, heavily reliant on Russian natural gas imports. This week it suspended supplies to Poland and Bulgaria because they refused to pay for the gas in rubles. Russia’s move was branded as “blackmail” by the EU but defended by Moscow.

While a direct confrontation between Russia and the West remains unlikely, one close Russia watcher said Western governments need to imbue their populations with a “war mentality” to prepare them for the hardships they could face as the economic fallout from the war continues. Those include rising energy costs and disrupted supply chains and goods from Russia and Ukraine, among the world’s biggest “bread baskets.”

“We’re likely to see a further escalation of the economic war, because in some ways, that’s a rational and logical move from both sides that have a very difficult time fighting one another in a direct way because of the nuclear escalation risks,” Maximilian Hess, a fellow at the Foreign Policy Research Institute, told CNBC on Thursday.

“Russia will cut off gas to more countries, it will increase its ruble demands, because it wants to ensure the ruble convertibility remains open, and the West needs to be preparing for this with a full war mentality, making the Western populations understand that this is going to have real economic costs and real impacts on the cost of goods, the cost of living and inflation over the coming years.”

“If we don’t take this war mentality and apply it to the economic war, then it becomes a lot easier for Putin to win and have successes there,” Hess said.

Other flashpoints to watch

After more than two months of war, Russia has expanded its control of territories in eastern and southern Ukraine, trying to create a land bridge from Russia via the Donbas region to its annexed territory of Crimea. But it has also sustained large losses in terms of manpower and arms.

In the meantime, the West continues to pledge more and more support for Ukraine, and the country’s forces are mounting a strong resistance to Russian troops, signaling a protracted and bloody conflict ahead. NATO’s chief, Jens Stoltenberg, warned Thursday that the war in Ukraine could last for years.

Andrius Tursa, Central and Eastern Europe advisor at Teneo Intelligence, said that against this backdrop, “there is no end in sight to Russia’s war in Ukraine, and relations with the West will likely continue to deteriorate.”

“The rhetoric in Russia is already shifting from statements of fighting the ‘nationalists’ in Ukraine to an alleged (proxy) war with NATO. Multiple flashpoints could further escalate the tensions with the West,” he said. Those include recent explosions in the breakaway Moldovan region of Transnistria (which could serve as a pretext for an increased Russian presence in the region) which could bring the conflict “dangerously close to NATO’s borders,” Tursa said in a note Wednesday.

“Moscow could also step up threats to NATO over weapons supplies to Ukraine, especially after multiple military and energy facilities in Russia have been allegedly hit by Ukraine. Finally, decisions by Finland and Sweden to join NATO would be perceived by Moscow as another security threat to Russia and could increase military tensions in the Baltic region.”

source https://www.cnbc.com/2022/04/29/russia-ukraine-war-should-the-west-prepare-for-war-with-putin.html

The post Could there be war between Russia and the West? Strategists predict what could happen next first appeared on MemberForex.

.png)