.jpg.67ebc317db6c1f3073d6bb9f92167e64.jpg)

What Is Trading Volume?

Trading volume refers to the number of options contracts buyers and sellers are exchanging during any given period, usually a trading day. It is monitored for individual securities and can be summarized for stocks, sectors or entire markets as well. Trading volume for options is calculated by totaling the number of contracts that transact within a specific period. For example, if five investors collectively buy 2,000 of a specific put option contract that has the same strike price and expiration date, then the trading volume for that contract that day is 2,000. Join our options trading service to learn more.

Why Trading Volume matters?

Whether an option is bought or sold, whether it is a call or a put, when it trades on the exchange, it is considered volume. In short, option volume is the number of contracts traded in a security or an entire market during a specific time frame, usually one trading day. It is simply the amount of options that change hands from sellers to buyers as a measure of activity. If a buyer purchases 100 contracts from a seller or a market maker, then the volume for that period increases by 100 contracts based on that transaction.

Let’s look at another example. Say Jim buys 100 calls for XYZ Inc. (XYZ) at the October 30 strike. On the same day, Bill buys 200 calls for the same strike and month. Total volume for XYZ’s October 30 strike would then equal 300 contracts (100 calls + 200 calls = 300). This result would hold true regardless of whether the XYZ calls were bought or sold by either Jim or Bill. As you can see, option volume indicates the number of contracts traded at a particular strike for a particular option for a specified time frame.

Option volume is a useful tool for traders, as it can point out where traders are focusing their attention on an intraday basis. For instance, assume that XYZ Inc. reported strong earnings prior to the market open and opened higher when trading began. High call option volume could be the result of such an occurrence, as options traders try to take advantage of the underlying stock’s move higher. Vice versa, a negative reaction to the same report could bring about a spike in put option volume. However, if you did not know that XYZ Inc. reported earnings, but saw the heavy option volume changing hands on the stock, you would know that options players were speculating on some event or move in the shares. As such, option volume can be an handy indicator for events (known or unknown) surrounding a particular stock.

What Is Open Interest?

Open interest measures the total number of open contracts for any specific option. That includes all long positions held by investors that have been opened but haven’t yet been exercised, closed out, or expired. Open interest is tallied for each option (puts separate from calls) and can be summarized by option type, expiration, exchange, or for the entire listed option market. Open interest is updated each night from all transactions, and posted for the next day. Thus, it does not change during the trading day.

Open interest will rise after an option begins trading as investors take on new positions. It will then either rise or decline on any given day as a result of new positions, positions closed, or options exercised the previous day.

Open Interest Example

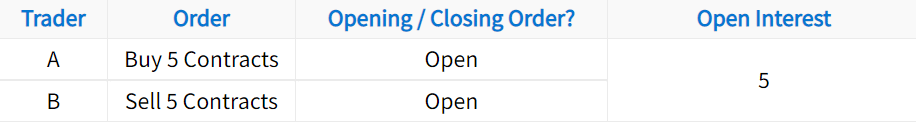

Here, Trader A is buying-to-open 5 contracts to open and Trader B is selling 5 contracts to open. Both of these simple trading strategies are new positions.

If both traders are filled on their orders, the option’s open interest will increase by 5 because two traders have opened positions in that contract.

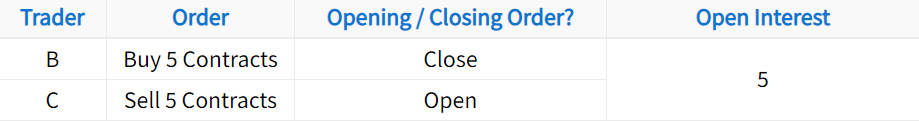

What happens when one of the traders closes their position while another trader opens a position? Consider the following trades:

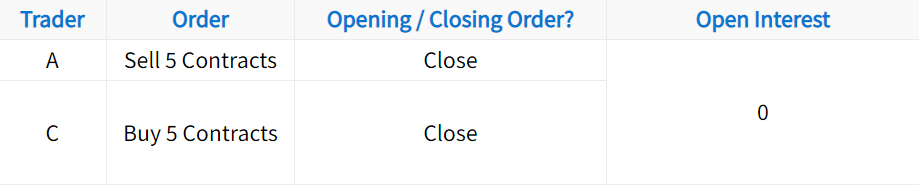

As we can see here, Trader B bought 5 contracts to close while Trader C sold 5 contracts to open. In this case, open interest remains at 5 because there are still 5 contracts open between Trader A and C. However, if Trader A sells 5 contracts to close and Trader C buys 5 contracts to close, open interest will decrease by 5:

So, open interest represents the number of option contracts that are open in the market between two parties, though you don’t need to be concerned about the specific parties.

Why Open Interest Matters

When you are looking at the total open interest of an option, there is no way of knowing whether the options were bought or sold. That’s probably why many options traders ignore open interest altogether. However, you shouldn’t assume that there’s no important information there.

One way to use open interest is to look at it relative to the volume of contracts traded. When the volume exceeds the existing open interest on a given day, it suggests that trading in that option was exceptionally high that day.

Open interest also gives you key information regarding the liquidity of an option. If there is no open interest in an option, there is no secondary market for that option. When options have a significant open interest, it means there are a large number of buyers and sellers out there. An active secondary market increases the odds of getting option orders filled at good prices.

All other things being equal, the bigger the open interest, the easier it will be to trade that option at a reasonable spread between the bid and ask.

For example, suppose you look at options on Apple Inc. and see the open interest is 12,000. This suggests that the market in Apple options is active and there may be a lot of investors in the marketplace who want to trade. The bid price of the option is $1 and the offer price of the option is $1.05. Therefore, it is likely you can buy one call option contract at the mid-market price.

On the other hand, suppose the open interest is 1. This indicates there is very little open interest in those call options and there is no secondary market because there are very few interested buyers and sellers. It would be difficult to enter and exit those options at good prices.

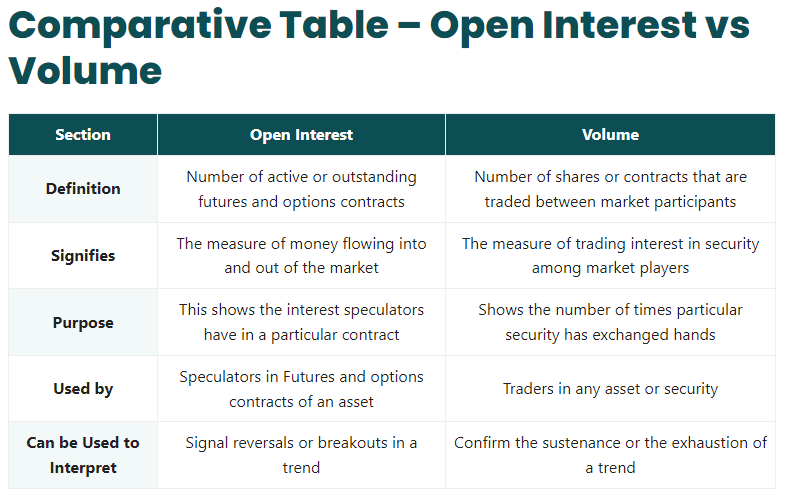

Image by wallstreetmojo.com.

The Importance of Option Liquidity

An option’s volume and open interest are very important to you as an options trader because you do not want to get caught trading illiquid options (low volume and low open interest). Illiquid options tend to have wide bid-ask spreads , which can have a significant impact on your trading account. It will be more difficult to get the price you are looking for, thereby forcing you to accept a lower price for a sale or pay a higher price for a purchase than you might want. Furthermore, if your order for an option does not get executed in a timely fashion, the underlying stock might move in price, changing the parameters of your intended strategy. Active option traders view liquidity as a very important criteria in selecting and executing their strategies.

Additionally, it’s harder to get out of option positions at good prices when volume and open interest are low, which means losses may grow larger due to the inability to exit a position.

What are ideal levels of volume and open interest? At the bare minimum, the options you use for your positions should have volume in the hundreds and open interest in the thousands:

- Minimum Daily Volume: 100s, preferably 1,000s.

- Minimum Open Interest: 1,000s.

At this point, you understand the basics of volume and open interest, and why they’re important to you as an options trader. In the next section, we’ll go over which options on a stock tend to have the most of each.

Potential Trading Signals

Here’s an overview of some potential volume and open interest trading signals to watch out for:

-

If prices are rising and call contract open interest is also rising, it could be a bullish signal that buyers are establishing new long positions.

-

If prices are rising but call contract open interest is falling, it could be a bearish signal that traders are losing conviction in the bullish trend.

-

If prices are falling but open interest in put contracts is rising, it could be a bearish signal that traders are opening new short positions.

- If prices are falling but call contract open interest is also falling, call holders may be getting forced out of their positions by margin calls, which could be a bearish short-term indicator but also an indication that a bottom could be near.

Bottom Line

Options trading volume and open interest are metrics that help investors better understand and interpret market action in both the options themselves and in their underlying stocks. They also provide a gauge on how liquid an options contract is and how easily it will be to favorably open or close a position in it. While both metrics have limitations, when combined with other data, they help investors understand options liquidity better and make better informed trading choices.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!