An option’s terminal value is entirely reliant on the underlying stock’s price on the expiration date, making values far more calculable.

But crunching some numbers and coming up with a reasonable value for an option doesn’t mean you know how to trade them profitably. The secret sauce is using your understanding of options pricing to predict how it’ll change in the future.

Primarily, that understanding comes down to interpreting how the different pricing factors, known as option Greeks, will change with time. The most critical Greeks are Delta, Theta, Vega, and Gamma.

And gamma is the worst understood of the Greeks while also holding the potential to be their most influential.

What is Gamma?

Put simply, gamma measures how fast or slow the delta will change. Options with high gamma values will change far quicker than those with low gamma values.

In more technical terms, gamma is the rate of change of delta. Basically, if we have a call option with a delta of 0.20 and a gamma of 0.02, a $1 increase in the stock will increase delta by 0.02 to 0.22.

Being long gamma is the same as being long options, as all long option positions have positive gamma, while all short options positions have negative gamma.

If you’re looking to get on board for a trend in a stock, you want to be very long gamma. High gamma is like a snowball rolling down a hill when a stock is trending. As the stock continues to trend, long gamma positions benefit more and more the longer the trend lasts.

This works because as the stock goes up, high gamma pushes delta upwards, making each successive move more significant in terms of P&L.

Gamma’s Relationship With Time and Moneyness

As a rule, the closer an option’s strike price is to the at-the-money strike, the higher the gamma is. The further out-of-the-money, the lower its gamma.

Furthermore, gamma increases as the expiration date of an option approach. To understand this intuitively, take an option at expiration. It either has a delta of 1 (expired ITM) or 0 (expired OTM and thus worthless).

Now let’s rewind the clock by five minutes. The underlying is at 99.95, and we own the 100 call. This option’s fate will be decided in five minutes, resulting in a delta of either 1 or 0. For this reason, it makes sense for delta to move a lot with each price change when we’re so close to the money.

Gamma Risk: An Introduction

Understanding the unique exposure to each Greek pose is one of the building blocks of options trading. It allows you to be more thoughtful when constructing positions.

Think of gamma as a horsepower rating for an options position. The higher the gamma, the quicker the option price can change. A little pressure on the throttle of a Porsche 911 can still make a big move. Conversely, putting the pedal to the metal in a 1970s Honda barely gets you to highway speed.

To provide context, let’s look at two call options in the same stock: one with high and one with low gamma.

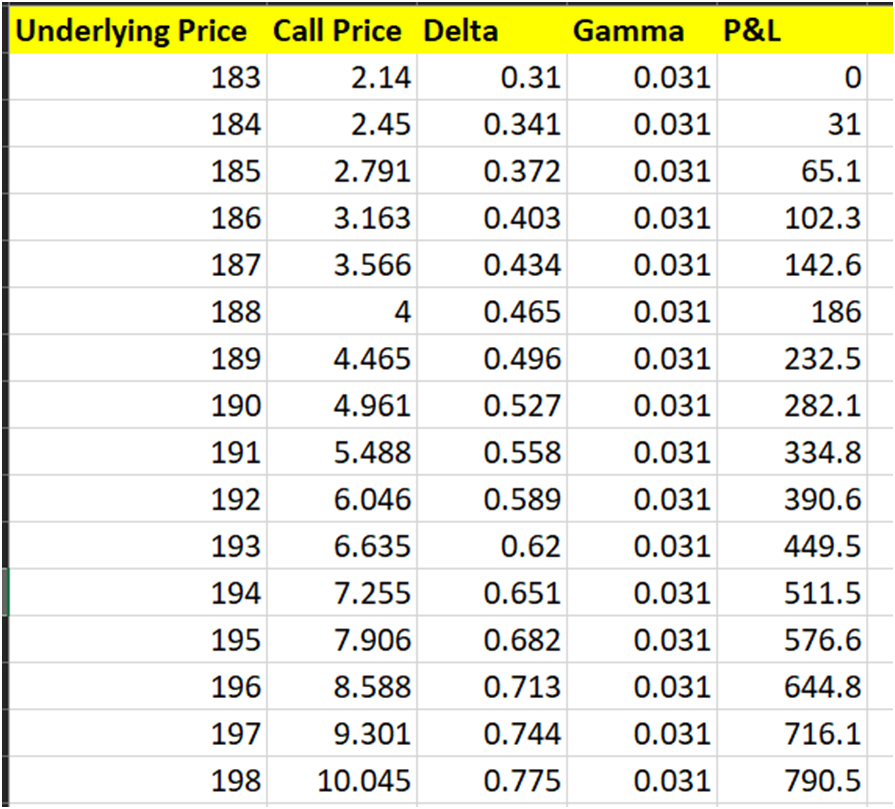

First, we have a 0.31 delta, 0.031 gamma TSLA 187.5 call trading at $2.14, expiring in one day. With spot TSLA trading at 183, let’s look at how quickly the value of this option can change.

Keep in mind that this is napkin math. Gamma doesn’t stay constant, nor are we accounting for theta decay or vega here. The point is to demonstrate how gamma can be like rocket fuel for an options position, good or bad. With each price increase, the ensuing price increase is more intense.

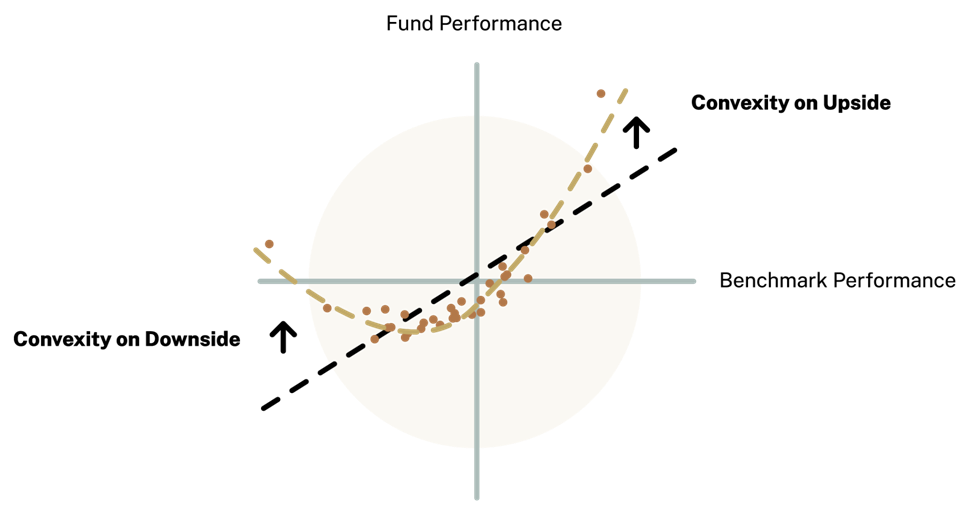

You’ll frequently hear the word “convexity” thrown around in options circles, which is essentially what they mean by that. As Simplify Asset Management puts it, convexity is when an investment payoff is curved upwards. See their graphic below:

You can think of gamma as the slope of the yellow curve. The higher the gamma, the steeper that curve will be.

The effect of this is that when you make a good call when you’re long gamma, your profits increase exponentially the more right you are. In other words, if you own the same Tesla call we referenced earlier, the P&L you make “per tick” increases with each successive tick until you’re in-the-money.

But just as you can be long gamma and benefit significantly from a runaway trend in a stock, you can also be short gamma.

And while it sounds lovely to be long gamma (it’s undoubtedly easier psychologically), there are some key benefits to being short gamma. Key among them is that you’re shorting options, and most options traders acknowledge that there’s an edge in being short options if you do it correctly.

Let’s return to the same Tesla call option example we just used, except this time, we decide to short the option, leaving us with the exact opposite position. So here’s where we’re at:

● Delta: -0.31

● Gamma: -0.031

● $2.14 (net credit)

● Expires in one day

Should we see the same scenario play out, where Tesla rallies aggressively, we’ll see the same phenomena occur. As this position goes against us, things just get worse and worse.

Bottom Line

We continue to hammer home the concept that trade-offs play such a massive role in options trading. Buying options gives us convexity with a defined risk, but we’re buying volatility which is overpriced on average, typically giving us a poor win rate.

Selling options typically gives us a steadier equity curve with more frequent wins, but we get bit in the rear end when an underlying begins to trend against our position, and short gamma quickly eats us alive.

As you develop as an options trader, you learn how each options Greek presents you with these sorts of complex trade-offs and how you can elegantly craft a position to fit your desired exposures very closely.

Related articles:

- Options Trading Greeks: Gamma For Speed

- Why You Should Not Ignore Negative Gamma

- Estimating Gamma For Calls Or Puts

- What Is Gamma Hedging And Why Is Everyone Talking About It?

- Short Gamma Vs. Long Gamma